Pour la version française, cliquez ici

Contents

Leaseweb invoice explained

To provide you with an easy and quick overview, we have will explain the format of our invoice. And to maintain uniformity, we have a new way of identifying the following:

- Invoice number example: 90123456

- Service identifier example: 41000012345678

Where to find it

You can find the invoice under the following menu in the Leaseweb Customer Portal:

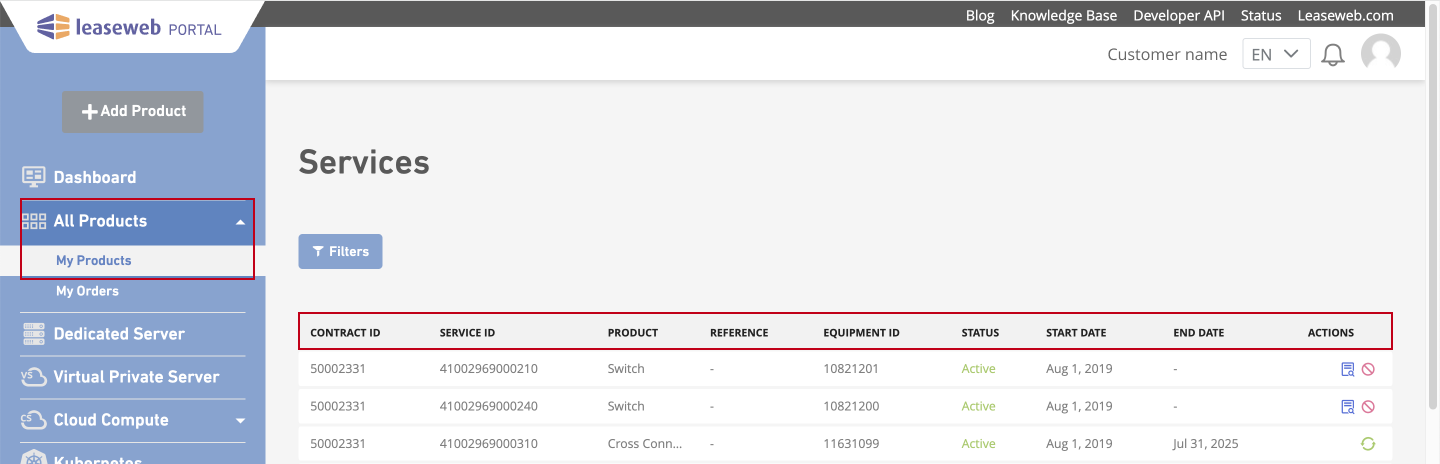

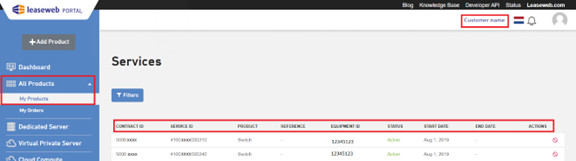

All Products screen

- Equipment ID or ID

- A Contract ID: This contract will contain all the equipment ordered at one time.

Note: We recommend that you add a reference to your services. This will help to identify them easily in the invoices. - Reference column will display the reference that you have added for this service in the customer portal.

- A Status column has been added. It displays the current status of your service. These are the following types of status it can display:

- New

- To be provisioned

- Scheduled

- Active

- To be modified

Please note:

- The Dashboard does not display a count of the total number of services under each product.

- We have improved our "Contacts" page. You can now add new contacts which will be recognized by Leaseweb when requesting support.

- Prepayment functionalities in the customer portal are no longer available.

- You old invoices are no longer available. You can request for them by creating a ticket with Customer Care.

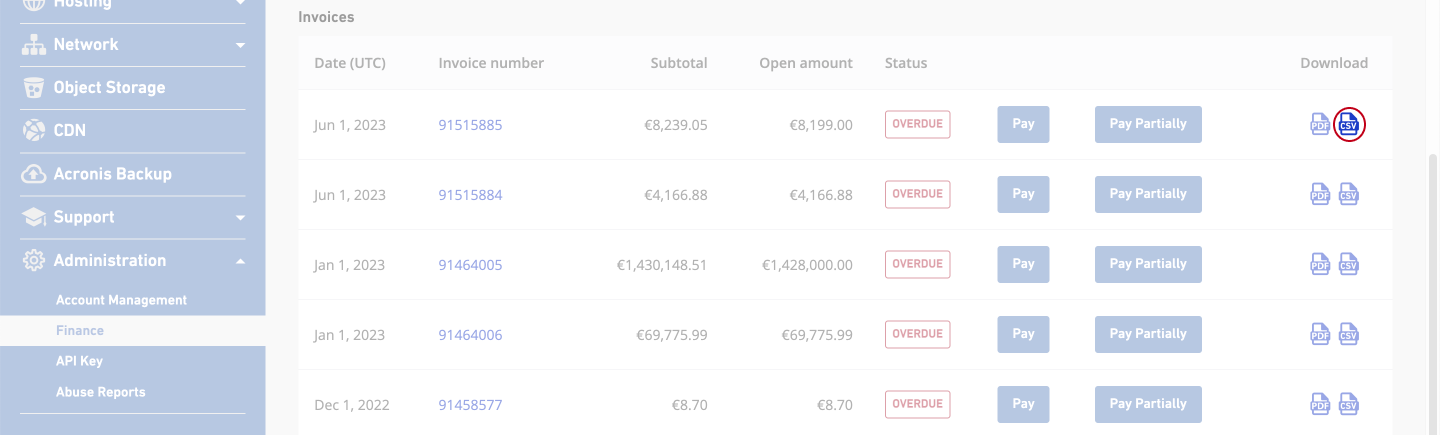

Downloadable formats

You can download the invoice in PDF format or CSV format.

- Old PDF, vs New PDF:

To continuously improve our service, Leaseweb is migrating to a new system, which will improve the current invoice layout.

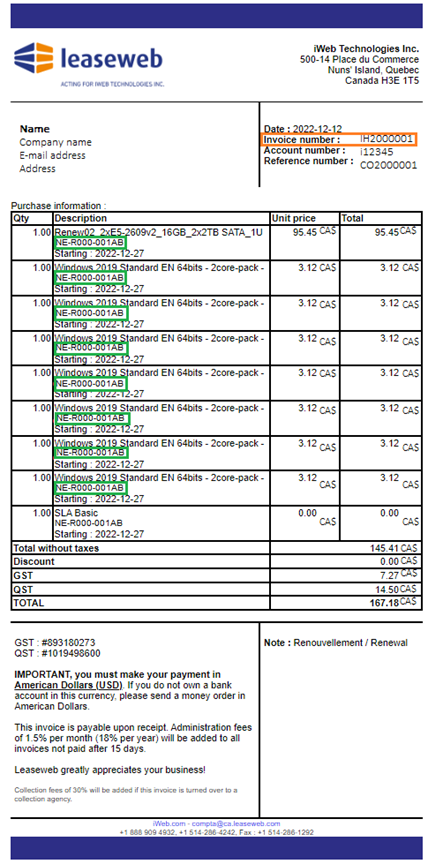

Old Invoice PDF

Changes:

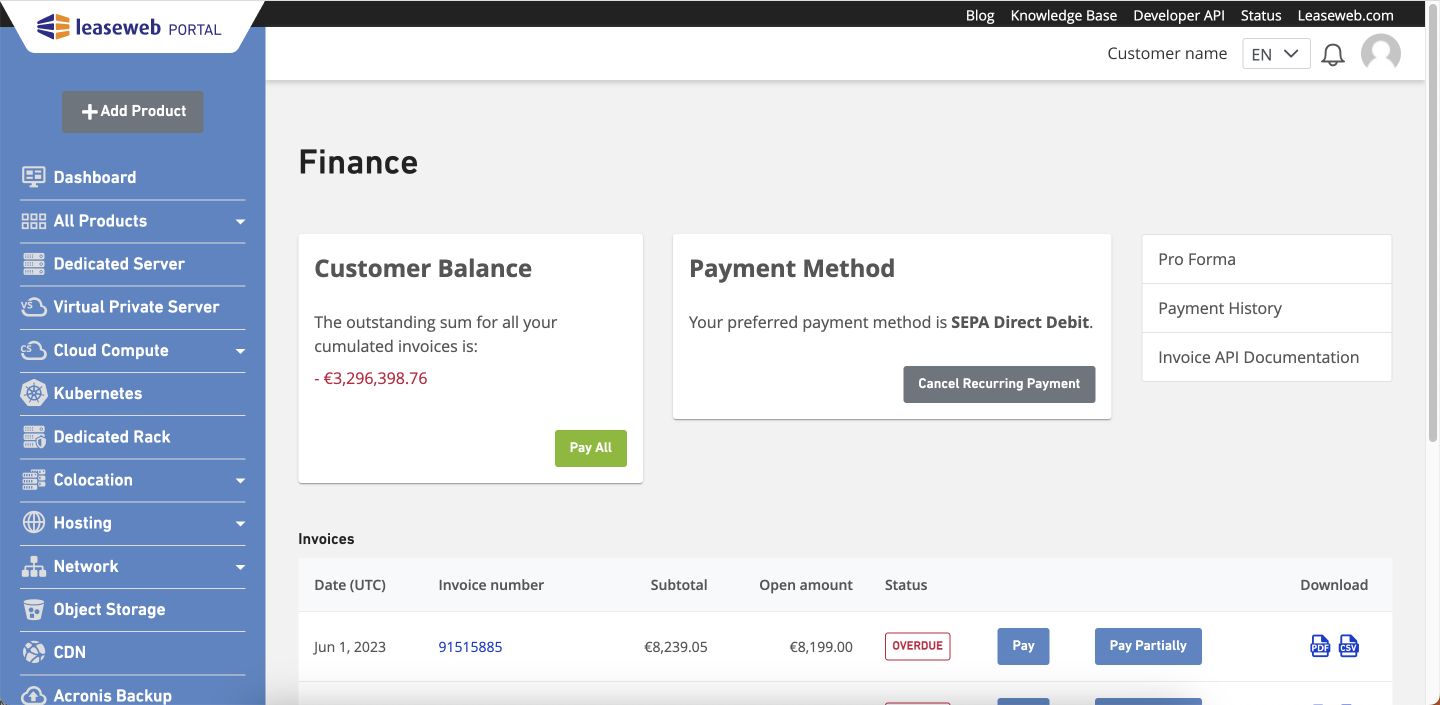

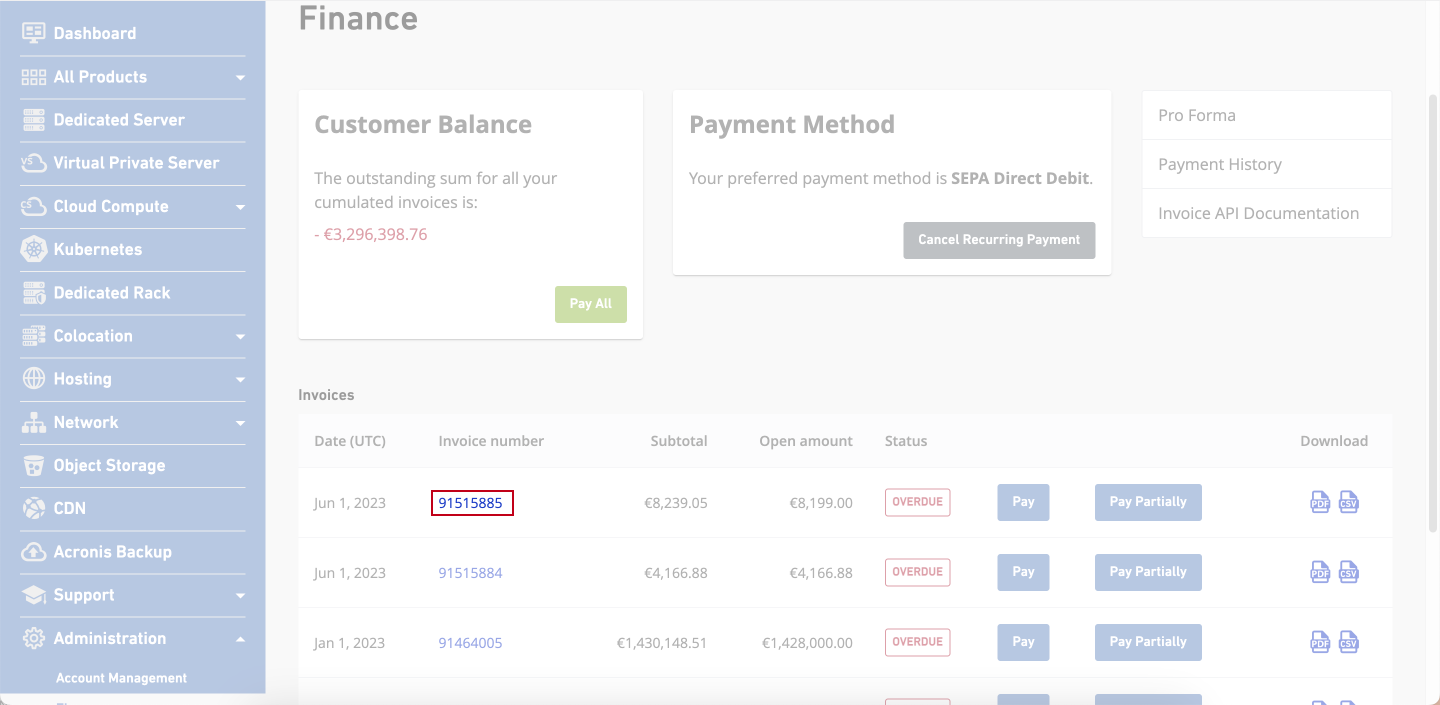

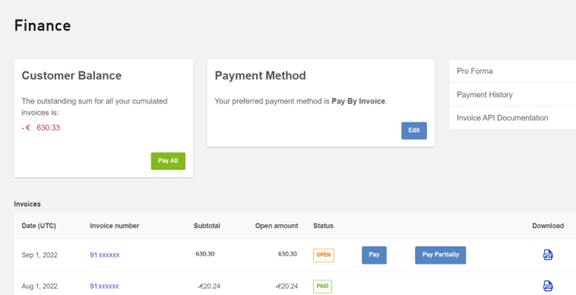

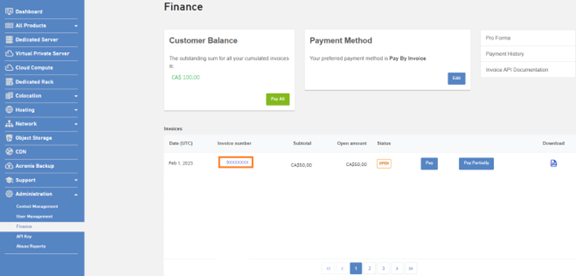

The Customer Hub will be replaced by the Leaseweb Customer Portal where you can manage your services. After logging in to the Customer Portal, click Administration on the left panel, and click Finance to view all details regarding the invoice which is explained below:

- Customer Balance: the outstanding sum for all your cumulated invoices

- Payment Method: you can set up your preferred payment method on the portal as a recurring method. The available methods are Credit cards and PayPal. If your invoices are debited automatically, you will need to actively re-subscribe your credit card and PayPal direct debit on the Leaseweb Customer Portal between February 7 - 28, 2023. It is important that you re-subscribe on time to ensure that your invoice payments are automatically debited from March 1, 2023. This is to prevent service interruptions due to late payment.

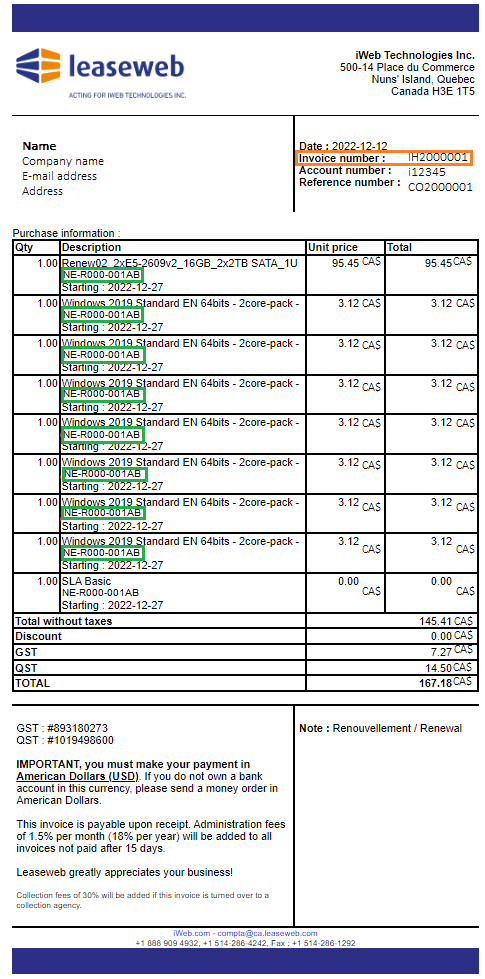

- Invoice number: the old invoice number started with IHXXXXXXX. Future invoice will start with 9XXXXXXX

- Proforma: on this page you will find all expected fees for the next month

The old invoices (IHXXXXXXX) and the payment history are not shown in the new portal, only the outstanding balance. If you wish to use these as a reference please download these before February 6, 2023.

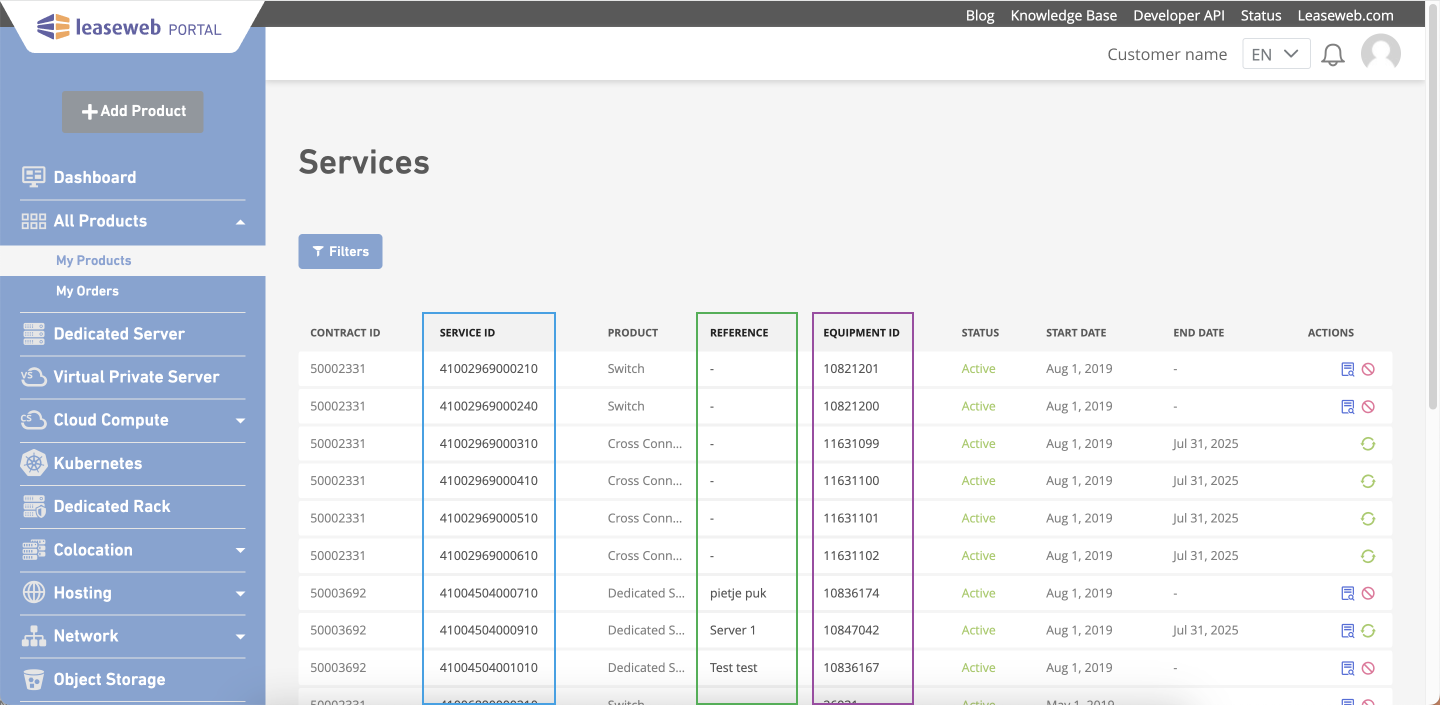

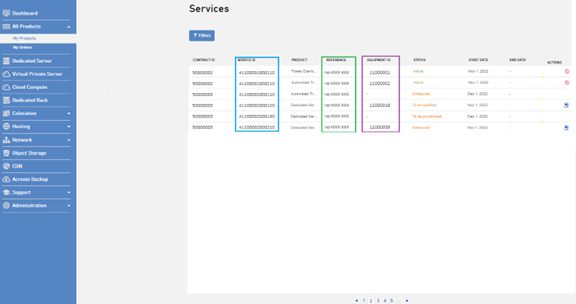

On the Services page of the Leaseweb Customer Portal (which can be found on the left panel under All Products > My Products), there are a few indicators you can use to read the new invoice format.

- Service ID: the order number with the item number in the order

- Reference: the old serverID which is moved to the reference. This field can be updated in the Customer Portal which will be reflected on the new invoice format

- Equipment ID: the new serverID which will be reflected on the new invoice format

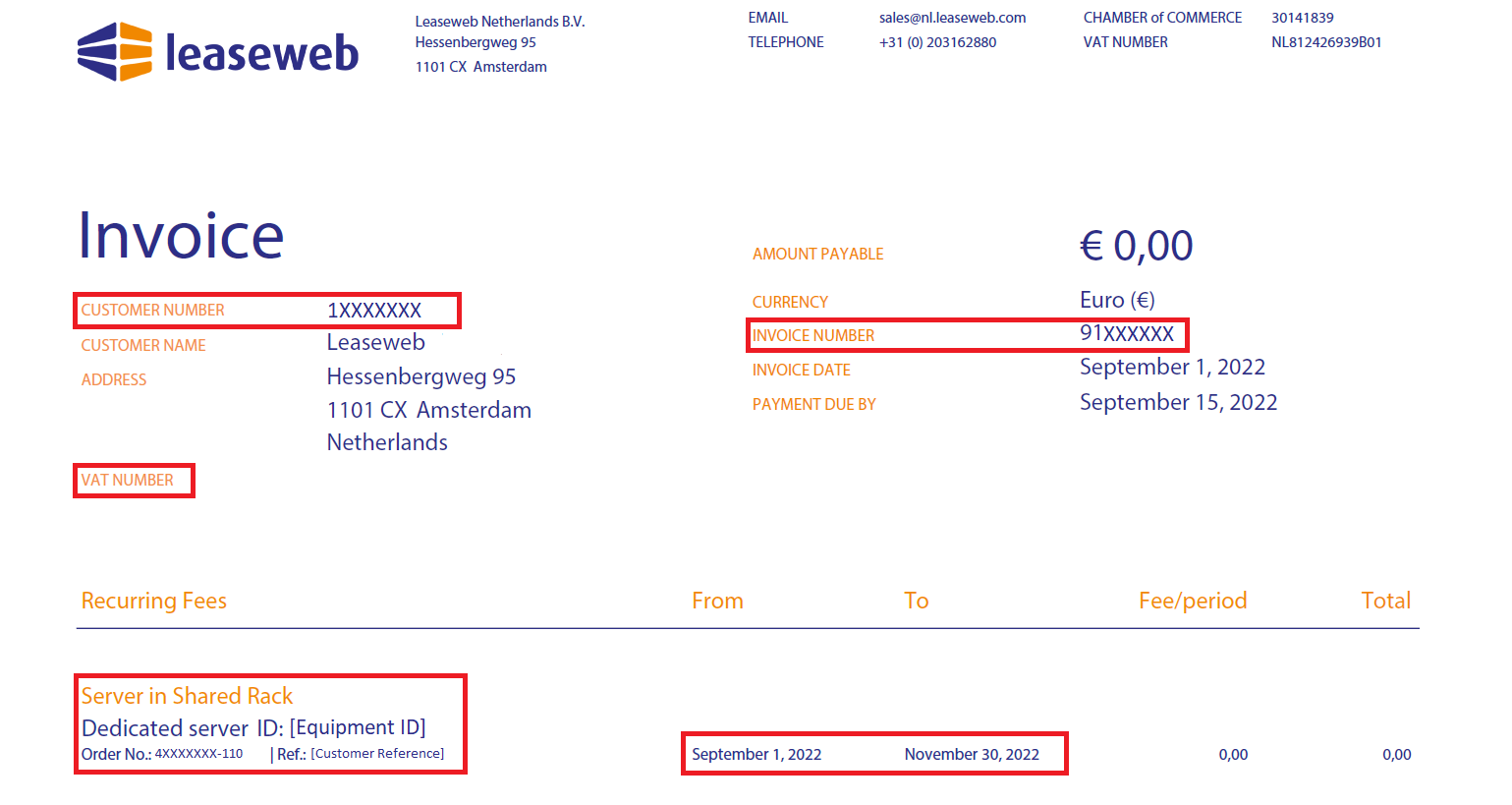

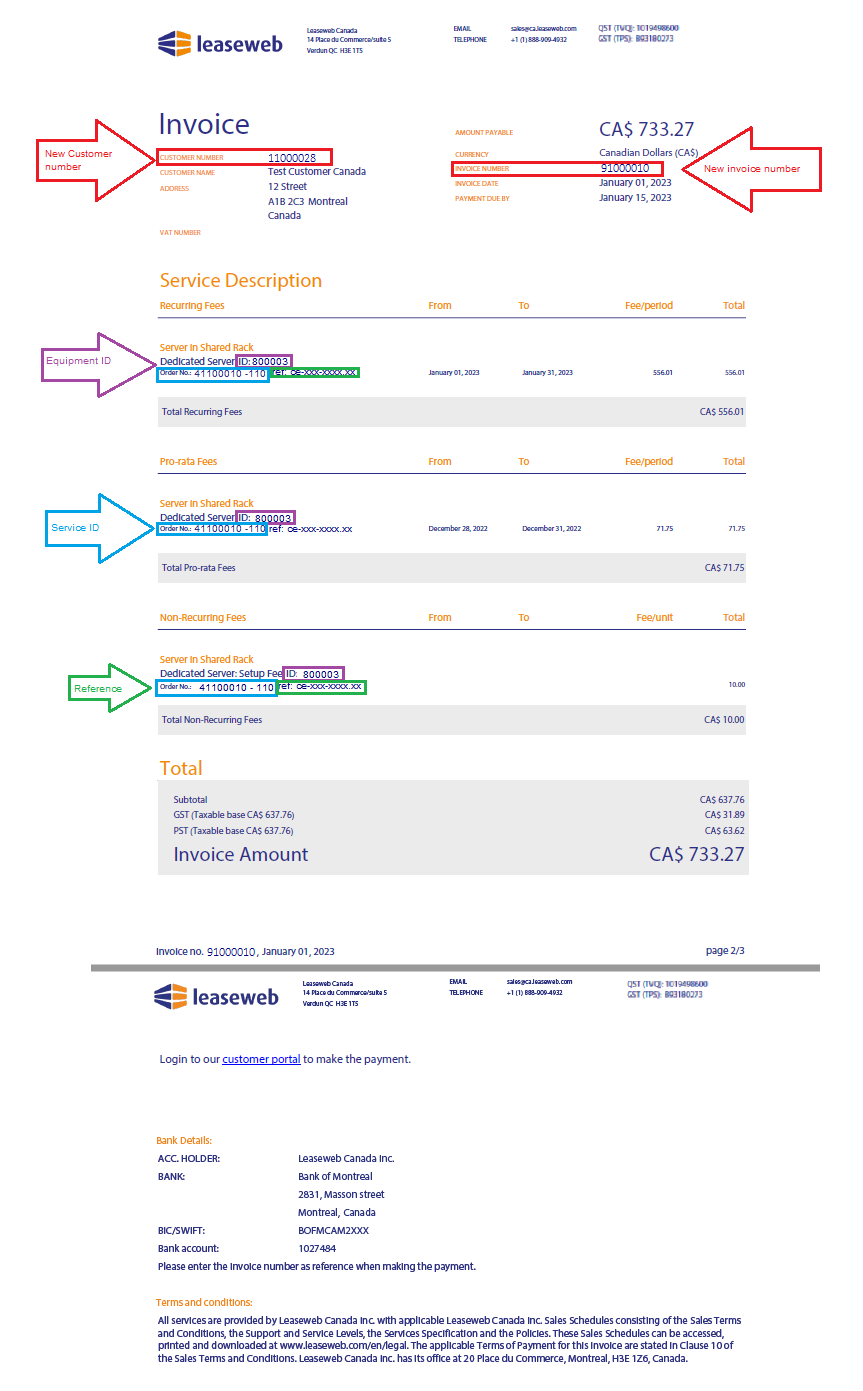

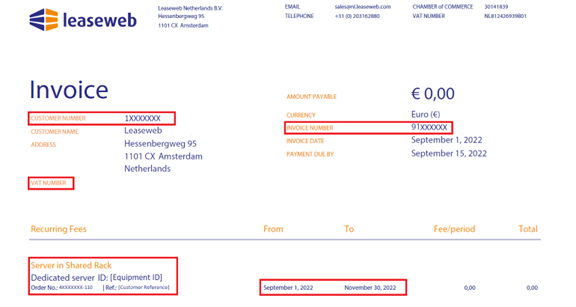

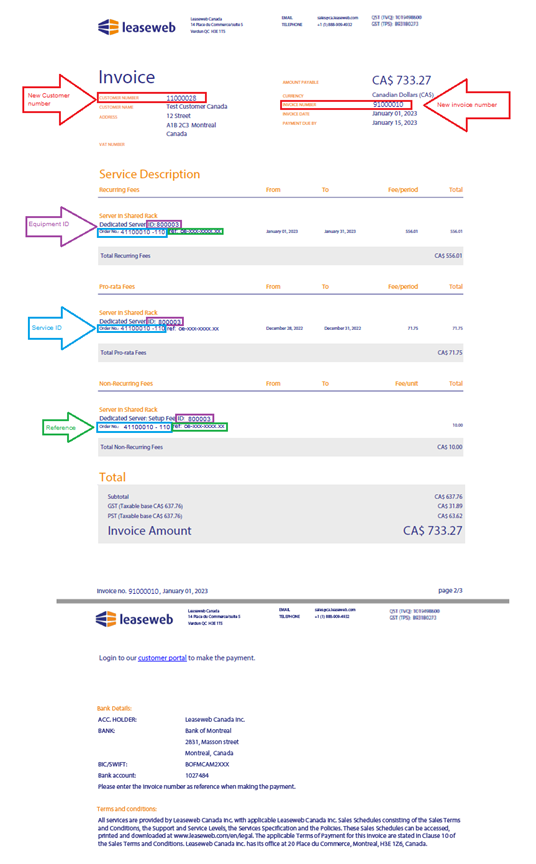

New Invoice PDF

There are some changes on the new invoice:

Old invoice | New invoice |

Every component 1 line | All components in the server will become 1 total price |

Starting date | From date |

The invoice date is 14 days less then the starting date of the service | The invoice date is always the 1th of the moth. The Payment Due By will show the date of when the services need to be paid taking the payment term into consideration |

CSV

To continuously improve our service, Leaseweb has now available invoices in CSV, which allows data to be saved in a table structured format (e.g. Excel).

The invoice anatomy

Every invoice you receive will display the following information:

- Your customer details (customer number, address, VAT registration number)

- What is being charged (services description including which period we charge you for)

- Our details (address, VAT registration number and bank details)

With external factors increasing our cost base, there may be an annual increase of our Services Fees based on our Sales Terms & Conditions. You can find them here. The revised rates always apply from 1 January onwards.

If you did not submit a valid VAT registration number, we will charge VAT for customers based in the EU and the UK.

We do not charge VAT to business customers who are located outside the country where Leaseweb is located if they have submitted valid VAT registration numbers.

Your VAT registration number is mentioned on your invoice. To add your VAT registration number to your account, please check this section: VAT charges

Pro-rata charge

Virtually all customers will find a one-time fee added to their first calendar month bill as a new customer, or when new services are added.

All Leaseweb services are billed by the calendar month, so the billing period for your Leaseweb services will always start at the first of the month. If you order a new service or are a new customer, the start date will often not be the first of the month. This is why there will be a one-time fee added to your first invoice showing the new service or, as a new customer. This covers the phase between the start of your service (i.e. the day on which the server is ready to use), and the first day of the next month.

On your proforma invoice, the one-time fee can be identified by the date, for example: "XXX001 From 15-4-2005 to 1-5-2005 EUR 89,00". This one-time fee will also appear on the official invoice for your administration.

Please refer to the article on Prepaid explanation for further information.

VAT charges

Value added tax (VAT) is a consumption tax.

VAT on services

We charge VAT to all customers located within the European Union (EU), unless the customer has submitted a valid VAT registration number from the country where it is making the purchase from. VAT is charged to all customers that are located within the same EU country as the Leaseweb entity from where the customer is purchasing services irrespective of the availability of a valid VAT number. For this purpose the Leaseweb entities include Leaseweb Netherlands B.V., Leaseweb CDN B.V., Leaseweb Network B.V., Leaseweb Deutschland GmbH, Leaseweb UK Limited.

Leaseweb entities located within the EU do not charge VAT to customers located outside the European Union, unless specifically outlined otherwise below:

Russia – As a foreign supplier of e-services, Leaseweb entities (Leaseweb Netherlands BV, Leaseweb Deutschland GmbH, Leaseweb UK Limited) charge Russian VAT to customers that are located within the Russian Federation.

Leaseweb entities outside of the EU:

Russia – As a foreign supplier of e-services, Leaseweb USA Inc. charges Russian VAT to customers that are located within the Russian Federation.

VAT on goods

We are charging VAT for all our customers in case we are selling goods and the delivery takes place on our premises.

For foreign enterprises, it is quite easy to apply for a VAT refund:

- Register at the Dutch tax office ("Belastingdienst")

http://www.belastingdienst.nl/wps/wcm/connect/bldcontenten/themaoverstijgend/calculation_tools/registration_of_foreign_businesses_aid - Apply for VAT refund

http://www.belastingdienst.nl/wps/wcm/connect/bldcontenten/themaoverstijgend/calculation_tools/registration_of_foreign_businesses_aid

If you need more information, please contact contractmanagement@leaseweb.com.

Request copy invoice

You can download your invoices from the Leaseweb Customer Portal invoices - you can also view your current outstanding balance from this page. For any old invoice that is not available, you can request them by creating a ticket with Customer Care.

If you are unable to locate the invoice you are searching, or have further questions, please send us an email to:

| NL & UK | US | DE | SG | HK | AU |

|---|---|---|---|---|---|

| customercare@nl.leaseweb.com | customercare@us.leaseweb.com | customercare@de.leaseweb.com | customercare@sg.leaseweb.com | customercare@hk.leaseweb.com | customercare@au.leaseweb.com |

Invoices by post

In principle, Leaseweb sends invoices and reminders by email. This saves time, and also contributes to a cleaner environment. If you wish to receive your invoice by post, you can indicate this via the Leaseweb Customer Portal. In that case, we will print exactly the same PDF on a color printer and send it to you by post. Consequently, you will have your invoice a few days earlier if you print it yourself.

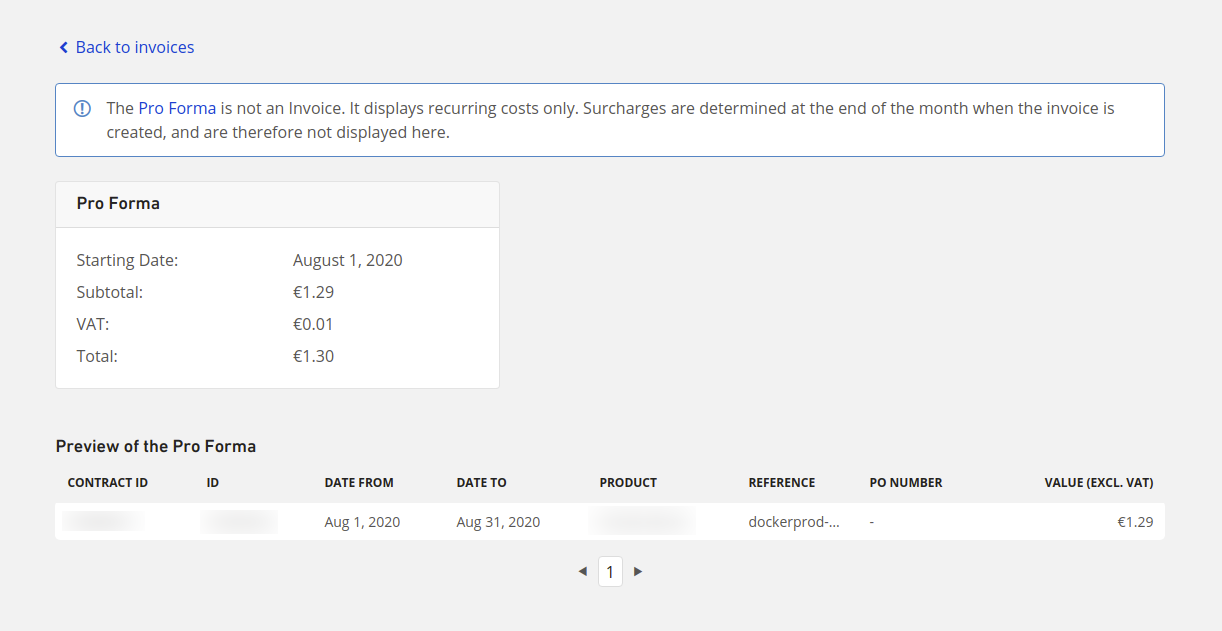

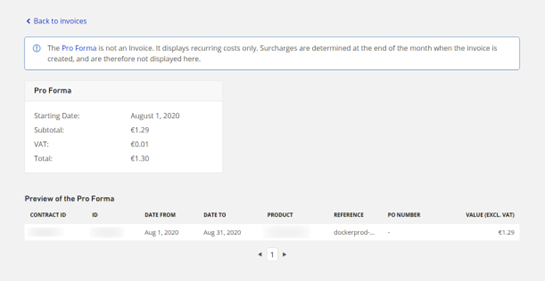

Pro Forma

The pro forma page will provide you with an option to look which of your products will be invoiced in the upcoming month. The pro forma takes into account your contract terms and billing cycles so you will see items listed that will be invoiced next month, however surcharges cannot be displayed in the pro forma.

The page looks like the following:

The Starting Date is the first day of the upcoming month from which new recurring items or new products are shown.

Items listed in pro forma

- Newly ordered products

- Products with recurring costs.

- One-off charges

Items not listed in pro forma

- Surcharges - as they are calculated on the end of the month before including them in the invoice.

Certificate of Residence

The request for the Certificate of Residence is linked to rules of tax law in an international treaty which deals with withholding tax and possible double taxation. The inspector of the local tax authorities declares that during a specific year, a Leaseweb entity is a resident of a specific country.

To submit your VAT registration or to request a Certificate of Residence form, you should create a ticket from the Leaseweb customer portal.

Please be informed that we will always validate your VAT registration number through the VIES portal of the European Commission. The VAT registration number that you submit will be checked using the following website: VIES VAT number validation on ec.europa.eu

We always charge VAT if delivery of a good takes place on our premises.

US Sales Tax

We charge Sales Tax based on policies relating to Infrastructure as a Service (IaaS) introduced by various states in the US. Sales Tax may be applied on some of your service(s). This tax is calculated based on the Billing Address on your account. If applicable, this Sales Tax will be applied to your invoice(s).

If your company has Sales Tax exemption, please email the certificate to us at ar@us.leaseweb.com.

To know more about this Sales Tax introduced by various states in the US, please visit Tax Foundation or read this article published on Baker Institute.

Factures

Description des factures Leaseweb et de leur structure

Format de la facture Leaseweb

Afin de vous fournir un aperçu simple et rapide, nous allons vous expliquer le format de notre facture. Et pour maintenir l'uniformité, nous avons une nouvelle façon d'identifier les éléments suivants :

- Numéro de facture

Exemple : 90123456 - Identifiant du service

Exemple : 41000012345678

Le portail client

Vous pouvez voir les pages suivantes dans le portail client de Leaseweb :

- Page de tous les produits

- Nouveau

- A provisionner

- Planifié

- Actif

- A modifier

- L'ID ou l'ID de l'équipement

- Un Numéro d’entente : Ce contrat contiendra tous les équipements commandés en une seule fois.

Remarque : Nous vous recommandons d'ajouter une référence à vos services. Cela permettra de les identifier facilement dans les factures. - La colonne Référence affichera la référence que vous avez ajoutée pour ce service dans le portail client.

- Une colonne Statut a été ajoutée. Elle affiche le statut actuel de votre service. Voici les types de statut qu'elle peut afficher :

- Page Finances

- Autres changements

- Le tableau de bord n'affiche pas un décompte du nombre total de services sous chaque produit.

- Vous pouvez désormais ajouter de nouveaux contacts qui seront reconnus par Leaseweb lors des demandes d'assistance.

- Les fonctionnalités de prépaiement dans le portail client ne sont plus disponibles.

- Vos anciennes factures ne sont plus disponibles. Vous pouvez les demander en créant un ticket auprès du service client.

La pièce jointe de la facture

Comment le format de facture de iWeb est mis en correspondance avec le format de facture de Leaseweb

Comment lire la nouvelle mise en page de la facture ?

Afin d'améliorer continuellement notre service, Leaseweb migre vers un nouveau système, ce qui améliorera la mise en page actuelle des factures.

Ancienne facture PDF

Informations sur les factures dans le portail client Leaseweb

Le Hub Client sera remplacé par le Portail Client Leaseweb où vous pourrez gérer vos services. Après vous être connecté au Portail Client, cliquez sur Administration dans le panneau de gauche, puis cliquez sur Finance pour afficher tous les détails concernant la facture qui sont expliqués ci-dessous :

- Solde client : la somme en souffrance pour toutes vos factures cumulées.

- Mode de paiement : vous pouvez configurer votre méthode de paiement préférée sur le portail comme une méthode récurrente. Les méthodes disponibles sont les cartes de crédit et PayPal. Si vos factures sont débitées automatiquement, vous devrez réinscrire activement votre carte de crédit et votre prélèvement PayPal sur le portail client Leaseweb entre le 7 et le 28 février 2023. Il est important que vous vous réinscriviez à temps pour que le paiement de vos factures soit automatiquement débité à partir du 1er mars 2023. Ceci afin d'éviter les interruptions de service dues à un retard de paiement.

- Numéro de facture : l'ancien numéro de facture commençait par IHXXXXXXX. Les futures factures commenceront par 9XXXXXXX.

- Proforma: sur cette page, vous trouverez tous les frais prévus pour le mois suivant.

Les anciennes factures (IHXXXXXXX) et l'historique des paiements n'apparaissent pas dans le nouveau portail, mais uniquement le solde restant. Si vous souhaitez les utiliser comme référence, veuillez les télécharger avant le 6 février 2023.

Sur la page Services du portail client Leaseweb (qui se trouve dans le panneau de gauche sous Tous les produits > Mes produits), il y a quelques indicateurs que vous pouvez utiliser pour lire le nouveau format de facture.

- Code de service: le numéro de commande avec le numéro d'article dans la commande

- Référence: l'ancien ID de l’équipement qui est déplacé vers la référence. Ce champ peut être mis à jour dans le portail client, ce qui se reflétera dans le nouveau format de facture.

- ID de l’équipement: le nouveau ID de l’équipement qui sera reflété sur le nouveau format de la facture.

Nouveau PDF de la facture

Il y a quelques changements sur la nouvelle facture :

Ancienne facture | Nouvelle facture |

Chaque composant 1 ligne | Tous les composants du serveur deviendront 1 prix total |

Date de début | Date de fin |

La date de facturation est inférieure de 14 jours à la date de début du service | La date de facturation est toujours le 1er du mois. L'échéance de paiement indique la date à laquelle les services doivent être payés en tenant compte du délai de paiement. |

Les factures de Leaseweb expliquées

Chaque facture que vous recevez contient les informations suivantes :

- Vos coordonnées client (numéro client, adresse, numéro de TVA).

- Ce qui vous est facturé (description des services, y compris la période pour laquelle nous vous facturons)

- Nos coordonnées (adresse, numéro de TVA et coordonnées bancaires).

En raison de facteurs externes augmentant notre base de coûts, il peut y avoir une augmentation annuelle de nos frais de services, conformément à nos conditions générales de vente. Vous pouvez les trouver ici. Les taux révisés s'appliquent toujours à partir du 1er janvier.

Si vous n'avez pas fourni un numéro de TVA valide, nous facturerons la TVA aux clients basés dans l'UE et au Royaume-Uni.

Nous ne facturons pas de TVA aux clients professionnels situés en dehors du pays où Leaseweb est implanté s'ils ont fourni un numéro de TVA valide.

Votre numéro de TVA est mentionné sur votre facture. Pour ajouter votre numéro de TVA à votre compte, veuillez consulter cette section : Frais de TVA

Charge au prorata

Pratiquement tous les clients verront des frais uniques ajoutés à leur première facture du mois civil en tant que nouveau client, ou lorsque de nouveaux services sont ajoutés.

Tous les services Leaseweb sont facturés par mois calendaire. La période de facturation de vos services Leaseweb commence donc toujours le premier du mois. Si vous commandez un nouveau service ou si vous êtes un nouveau client, la date de début ne sera souvent pas le premier du mois. C'est pourquoi des frais uniques sont ajoutés à votre première facture pour le nouveau service ou en tant que nouveau client. Ces frais couvrent la phase entre le début de votre service (c'est-à-dire le jour où le serveur est prêt à être utilisé) et le premier jour du mois suivant.

Sur votre facture proforma, la redevance unique peut être identifiée par la date, par exemple : "XXX001 Du 15-4-2005 au 1-5-2005 89,00 EUR". Cette redevance unique figurera également sur la facture officielle de votre administration.

Veuillez vous référer à l'article sur l'explication du prépaiement pour de plus amples informations.

Charge TVA

La taxe sur la valeur ajoutée (TVA) est un impôt sur la consommation.

TVA sur les services

Nous facturons la TVA à tous les clients situés dans l'Union européenne (UE), à moins que le client n'ait fourni un numéro de TVA valide dans le pays où il effectue son achat. La TVA est facturée à tous les clients situés dans le même pays de l'UE que l'entité Leaseweb auprès de laquelle le client achète des services, indépendamment de la disponibilité d'un numéro de TVA valide. À cette fin, les entités Leaseweb comprennent Leaseweb Netherlands B.V., Leaseweb CDN B.V., Leaseweb Network B.V., Leaseweb Deutschland GmbH, Leaseweb UK Limited.

Les entités Leaseweb situées dans l'Union européenne ne facturent pas de TVA aux clients situés en dehors de l'Union européenne

TVA sur les biens

Nous facturons la TVA pour tous nos clients dans le cas où nous vendons des marchandises et que la livraison a lieu dans nos locaux.

Pour les entreprises étrangères, il est assez facile de demander un remboursement de la TVA :

- S'inscrire auprès du bureau des impôts néerlandais ("Belastingdienst")

- Demander le remboursement de la TVA

Si vous avez besoin de plus d'informations, veuillez contacter contractmanagement@leaseweb.com.

Demande de copie de la facture

Vous pouvez télécharger vos factures à partir des factures du portail client Leaseweb - vous pouvez également consulter votre solde actuel à partir de cette page. Pour toute ancienne facture qui n'est pas disponible, vous pouvez en faire la demande en créant un ticket auprès du service clientèle.

Si vous ne parvenez pas à localiser la facture que vous recherchez, ou si vous avez d'autres questions, veuillez nous envoyer un e-mail à l'adresse suivante :

NL & UK | US | DE | SG | HK | AU | CA |

Factures par la poste

En principe, Leaseweb envoie les factures et les rappels par courrier électronique. Cela permet de gagner du temps et contribue également à un environnement plus propre. Si vous souhaitez recevoir votre facture par la poste, vous pouvez l'indiquer via le portail client de Leaseweb. Dans ce cas, nous imprimerons exactement le même PDF sur une imprimante couleur et vous l'enverrons par la poste. Vous recevrez donc votre facture quelques jours plus tôt si vous l'imprimez vous-même.

Pro Forma

La page pro forma vous permet de voir quels sont les produits qui seront facturés le mois prochain. La page pro forma tient compte des conditions de votre contrat et des cycles de facturation. Vous verrez donc apparaître les articles qui seront facturés le mois prochain, mais les suppléments ne peuvent pas être affichés dans la page pro forma.

La page ressemble à ce qui suit :

La date de début est le premier jour du mois à venir à partir duquel les nouveaux articles récurrents ou les nouveaux produits sont affichés.

Éléments figurant dans la liste pro forma

- Produits nouvellement commandés

- Produits avec des coûts récurrents.

- Charges uniques

Éléments ne figurant pas dans la liste pro forma

Suppléments - car ils sont calculés à la fin du mois avant d'être inclus dans la facture.

Certificate de Residence

La demande de certificat de résidence est liée aux règles du droit fiscal d'un traité international qui traite de la retenue à la source et d'une éventuelle double imposition. L'inspecteur des autorités fiscales locales déclare que, pendant une année donnée, une entité Leaseweb est résidente d'un pays spécifique.

Pour soumettre votre déclaration de TVA ou pour demander un formulaire d'attestation de résidence, vous devez créer un ticket depuis le portail client de Leaseweb.

Nous vous informons que nous validerons toujours votre numéro de TVA par le biais du portail VIES de la Commission européenne. Le numéro d'immatriculation à la TVA que vous soumettez sera vérifié sur le site Web suivant : Validation du numéro de TVA VIES sur ec.europa.eu

Nous facturons toujours la TVA si la livraison d'un bien a lieu dans nos locaux.

Taxe de vente États-Unis

Nous facturons la taxe de vente sur la base des politiques relatives à l'infrastructure en tant que service (IaaS) introduites par différents États des États-Unis. La taxe de vente peut être appliquée sur certains de vos services. Cette taxe est calculée sur la base de l'adresse de facturation de votre compte. Le cas échéant, cette taxe de vente sera appliquée à votre/vos facture(s).

Si votre entreprise bénéficie d'une exonération de la taxe sur les ventes, veuillez nous envoyer le certificat par courrier électronique à l'adresse suivante ar@us.leaseweb.com.

Pour en savoir plus sur cette taxe de vente introduite par différents États américains, veuillez consulter le site de la Tax Foundation ou lire cet article publié sur Baker Institute.